Recent investigation from Kasper Vandeloock suggest that popular YouTuber MrBeast, whose real name is James Stephen Donaldson, may have made millions from controversial cryptocurrency promotions. With a following of over 320 million on YouTube, MrBeast is one of the most recognizable influencers today, and his social media presence has been an appealing platform for up-and-coming crypto projects.

According to on-chain data analyzed by blockchain investigators from firms like Loock.io and prominent crypto analyst hxnterson, angelfacepeanut, somaxbt and rfparson, MrBeast allegedly leveraged his massive reach to support these projects, then profited through what some label as “insider trading.” These claims include accusations of strategically promoting and later selling off these tokens after they surged in value, leaving his followers to face the consequences.

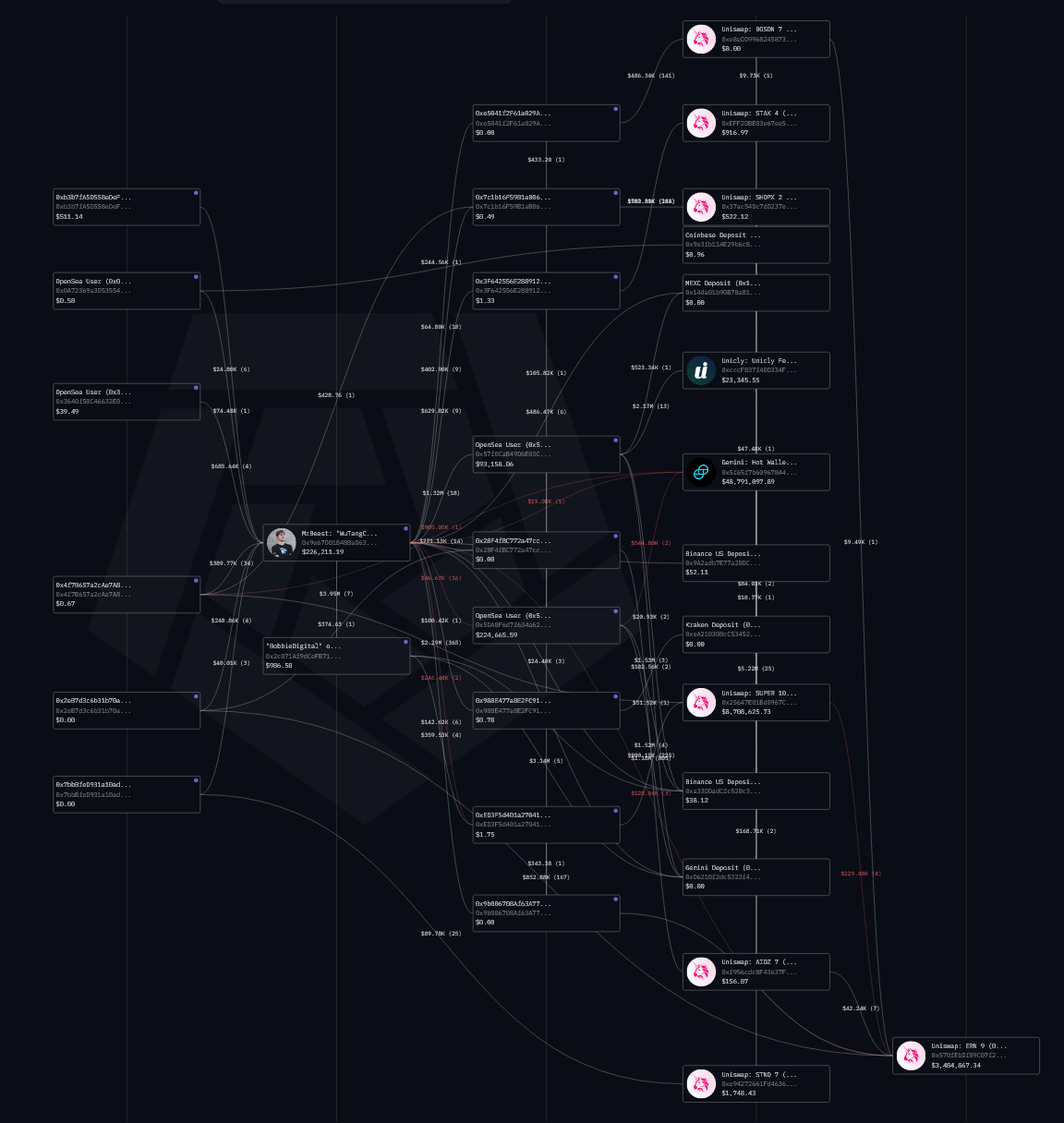

Wallet Connections and Ethereum Transactions

Image from Loock.io

The investigation points to a network of about 50 cryptocurrency wallets that have been associated with MrBeast, due in part to his publicly shared Ethereum address when he bought a CryptoPunk NFT during the 2021 NFT boom. By analyzing these wallet connections, researchers identified various accounts linked back to MrBeast, including those with the same Gemini exchange deposit address, further verifying the association.

MrBeast’s Most Profitable Crypto Venture?

One of MrBeast’s most lucrative projects appears to be SuperVerse, formerly known as SuperFarm. SuperVerse conducted an Initial Coin Offering (ICO) where tokens were sold at discounted rates to raise capital. MrBeast and his team were highly involved in promoting SuperVerse on platforms like Twitter (Now X) and YouTube, though many of those promotional posts have since been deleted. However, MrBeast still follows SuperVerse on social media, suggesting a potential ongoing association.

Following the launch, SuperVerse’s token value skyrocketed, climbing 50 times higher than its initial price. During this surge, early investors faced restrictions due to specific legal structures, yet MrBeast and other influencers like KSI reportedly capitalized by selling off tokens at peak value, yielding substantial profits.

Loock.io estimates MrBeast’s initial investment of $100,000 in SuperVerse resulted in a $7.5 million gain. This venture is said to be part of a broader series of promotions that earned Donaldson and his network around $10 million collectively from various crypto projects.

Influencer Influence on the Crypto Market

The involvement of mainstream celebrities in cryptocurrency has often led to unpredictable results, especially as these projects frequently fail to meet their projected growth. Many such ventures have seen celebrity-driven memecoins fizzle out shortly after launch, leaving everyday investors at a loss.

In June alone, over 30 meme tokens were launched by public figures, yet only a few survived the initial hype. The trend points to an emerging cycle of “celebrity grift,” where the perceived endorsement by a public figure propels a project briefly before it ultimately declines, impacting retail investors the hardest. People do not forget the charts.

The case of MrBeast serves as a cautionary tale for those who follow celebrity advice in high-risk markets like cryptocurrency. While influencers bring exposure to emerging technology, the outcomes for regular investors often hinge on factors far beyond an endorsement alone. DYOR or in these grifting cases, RUN.